Purchase a new subscription

This subscription includes 3 months of support for:

Support is provided for up to three (3) integrations, be it on the same or different sites.

This subscription includes 3 months of support for:

Support is provided for up to three (3) integrations, be it on the same or different sites.

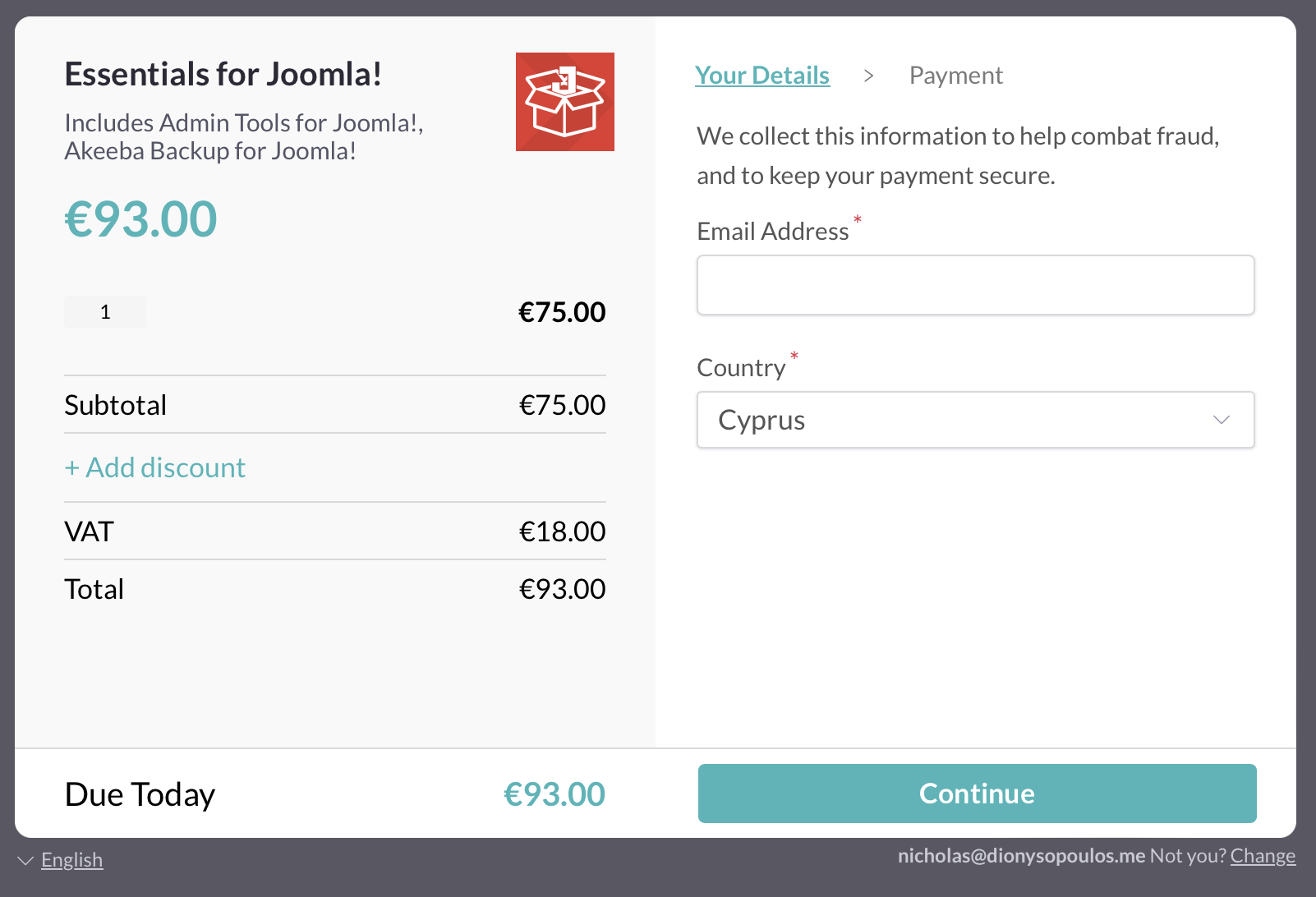

After clicking the Pay and Subscribe button on our site you are taken to the payment page managed by our reseller, Paddle. The first page lets you enter (or verify) your email address and country:

Even though you see VAT being applied, click on Continue.

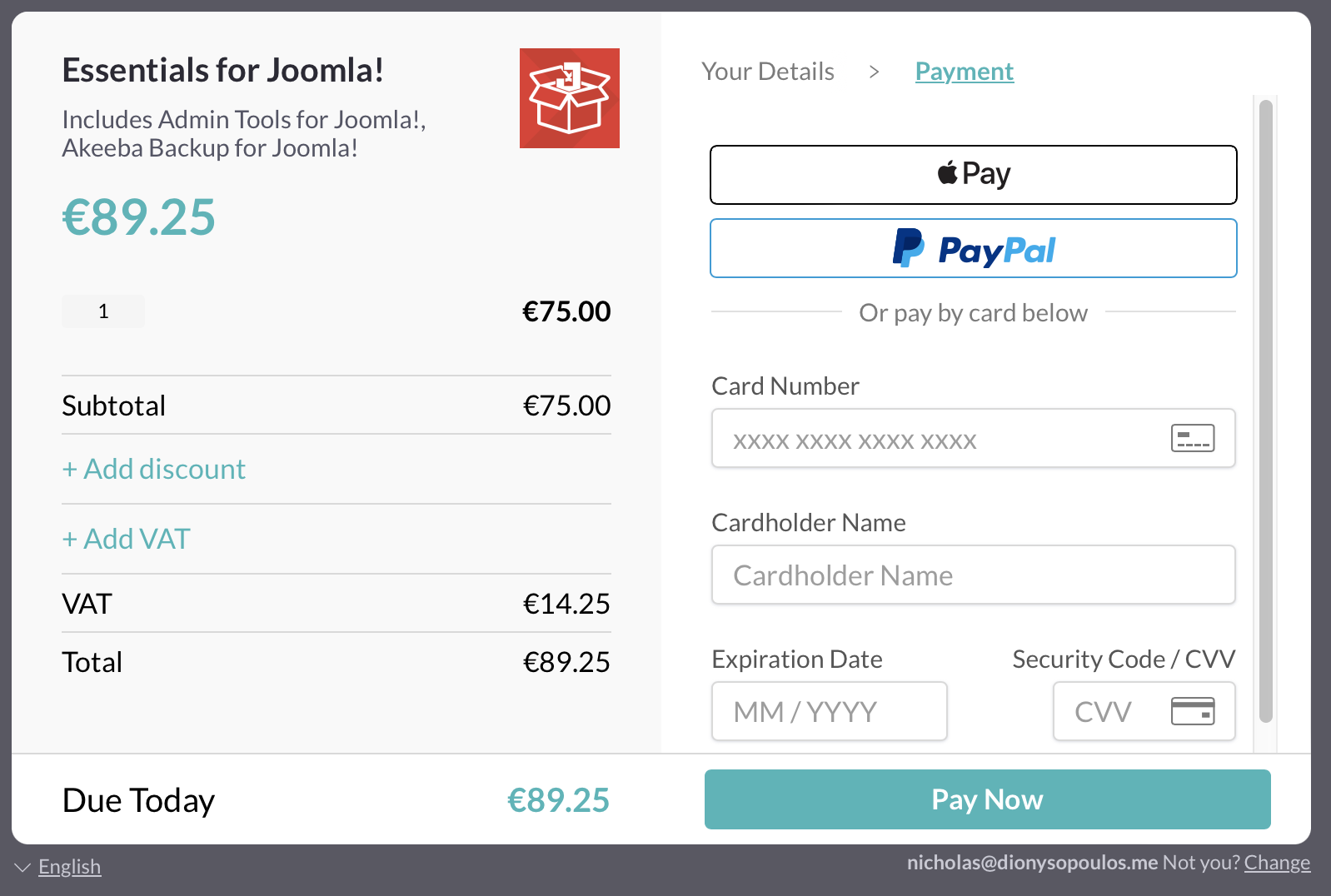

In the next page, look at the left hand side:

If you are an EU company click on the “+ Add VAT” link on the left hand side to enter your invoicing information, including your VAT number without the two-letter country prefix. You will see that no VAT is being charged.

If you entered a VAT number and VAT is still charged please check your VAT number with the EU VIES service:

If you a non-EU company the “+ Add VAT” link does not appear. Instead, proceed with the payment and follow the instructions below, under “Converting your receipt to an invoice”. Please note that sales tax may be added if applicable.

Good to know: Paddle is the Merchant of Record, meaning that you are paying Paddle, therefore the invoice is issued by Paddle, not Akeeba Ltd. Kindly note that Paddle is based in the United Kingdom. All UK businesses will be charged the applicable VAT regardless of whether they enter a valid VAT number, in accordance to local tax laws.

Paddle emails you with a payment receipt upon successful payment. This receipt is a valid tax invoice if you had already entered your invoicing information before payment.

If you did not enter your company’s invoicing information during payment for any reason you can do so within 7 days of the receipt having been issued. Follow the link in the email you received from Paddle to open the receipt in your browser. If you deleted this email you can still find that link after logging into our site, under My Subscriptions.

The left hand side of the receipt page has a blue link to enter your invoicing information. Click on it and enter your company information. This is enough to convert the receipt to a valid tax invoice. You can print that page, either to a piece of paper or a PDF file, and file it as a business expense.

If the link does not appear it may be the case that the receipt has been issued more than 7 days ago. In this case please contact Paddle as noted further above

If you forgot to enter your VAT number or the VAT number validation did not work at the time, please follow the “Converting your receipt to an invoice” instructions above. While doing that you will enter your VAT number. A VAT refund will be issued in the next few days.

According to our experience the invoice is not amended to show that no VAT was actually charged. If your tax jurisdiction does not allow that, please contact Paddle at help@paddle.com and do remember to include your invoice number.